Getting The Paul B Insurance Local Medicare Agent Huntington To Work

Wiki Article

The Of Paul B Insurance Medicare Part D Huntington

Table of ContentsMore About Paul B Insurance Medicare Part D HuntingtonAll About Paul B Insurance Medicare Advantage Agent HuntingtonThings about Paul B Insurance Medicare Insurance Program HuntingtonIndicators on Paul B Insurance Medicare Insurance Program Huntington You Should KnowHow Paul B Insurance Local Medicare Agent Huntington can Save You Time, Stress, and Money.

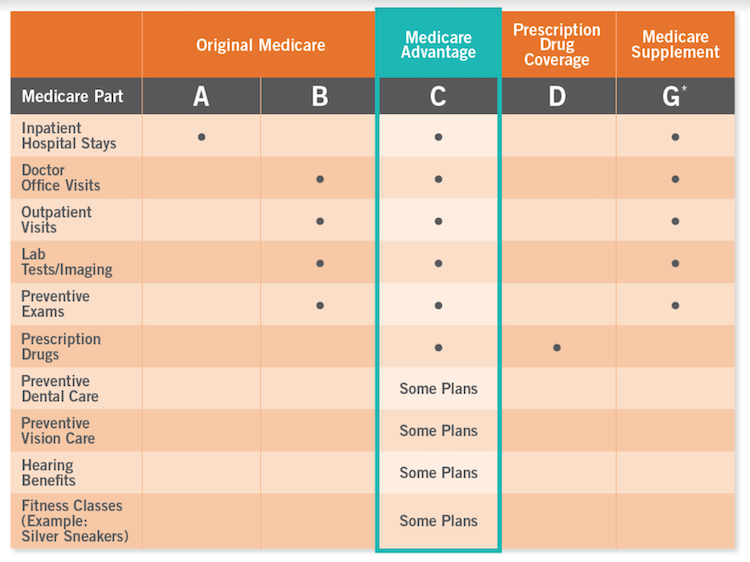

A: Initial Medicare, likewise referred to as typical Medicare, includes Component An and also Component B. It enables recipients to visit any doctor or healthcare facility that accepts Medicare, anywhere in the United States. Medicare will certainly pay its share of the fee for every service it covers. You pay the remainder, unless you have added insurance policy that covers those costs.

Attempting to make a decision which kind of Medicare strategy is best for you? We're below to assist. Find out more concerning the different components of Medicare and sorts of health care plans readily available to you, including HMO, PPO, SNP plans as well as even more.

Generally, the various parts of Medicare assistance cover details services.

It is sometimes called Typical Medicare or Fee-for-Service (FFS) Medicare. Under Original Medicare, the federal government pays straight for the wellness treatment services you obtain.

The Single Strategy To Use For Paul B Insurance Medicare Advantage Agent Huntington

It is necessary to comprehend your Medicare insurance coverage options and also to select your insurance coverage thoroughly. How you select to get your benefits and also who you obtain them from can influence your out-of-pocket expenses as well as where you can get your care. As an example, in Original Medicare, you are covered to head to almost all medical professionals and also health centers in the country.Medicare Benefit Plans can additionally give extra benefits that Original Medicare does not cover, such as regular vision or oral care.

Formularies can vary by plan, as well as they might not all cover your necessary medications. Therefore, it is very important to review offered coverages when contrasting Medicare Part D intends.

Before you sign up in a Medicare Benefit plan it is essential to recognize the following: Do every one of your service providers (doctors, health centers, and so on) approve the strategy? You have to have both Medicare Components An and also B and also reside in the solution location for the plan. You have to remain in the plan until completion of the fiscal year (there are a couple of exemptions to this).

Getting My Paul B Insurance Medicare Advantage Plans Huntington To Work

The majority of Medicare medication strategies have a coverage gap, likewise called the "donut hole." This indicates that after people with Medicare, check my blog called beneficiaries, as well as their strategies have invested a specific amount of money for protected medicines, the recipient may need to pay greater prices out-of-pocket for prescription drugs. The insurance coverage gap is one stage of the Medicare Component D prescription drug protection cycle.Knowing regarding Medicare can be a daunting job. But it doesn't have to be. HAP is here, helping you comprehend the fundamentals of Medicare (Parts A, B, C as well as D), the 3 primary kinds of Medicare (Original, Medicare Benefit, and Supplemental), as well as the enrollment timeline right from authorizing to changing when a strategy doesn't satisfy your demands.

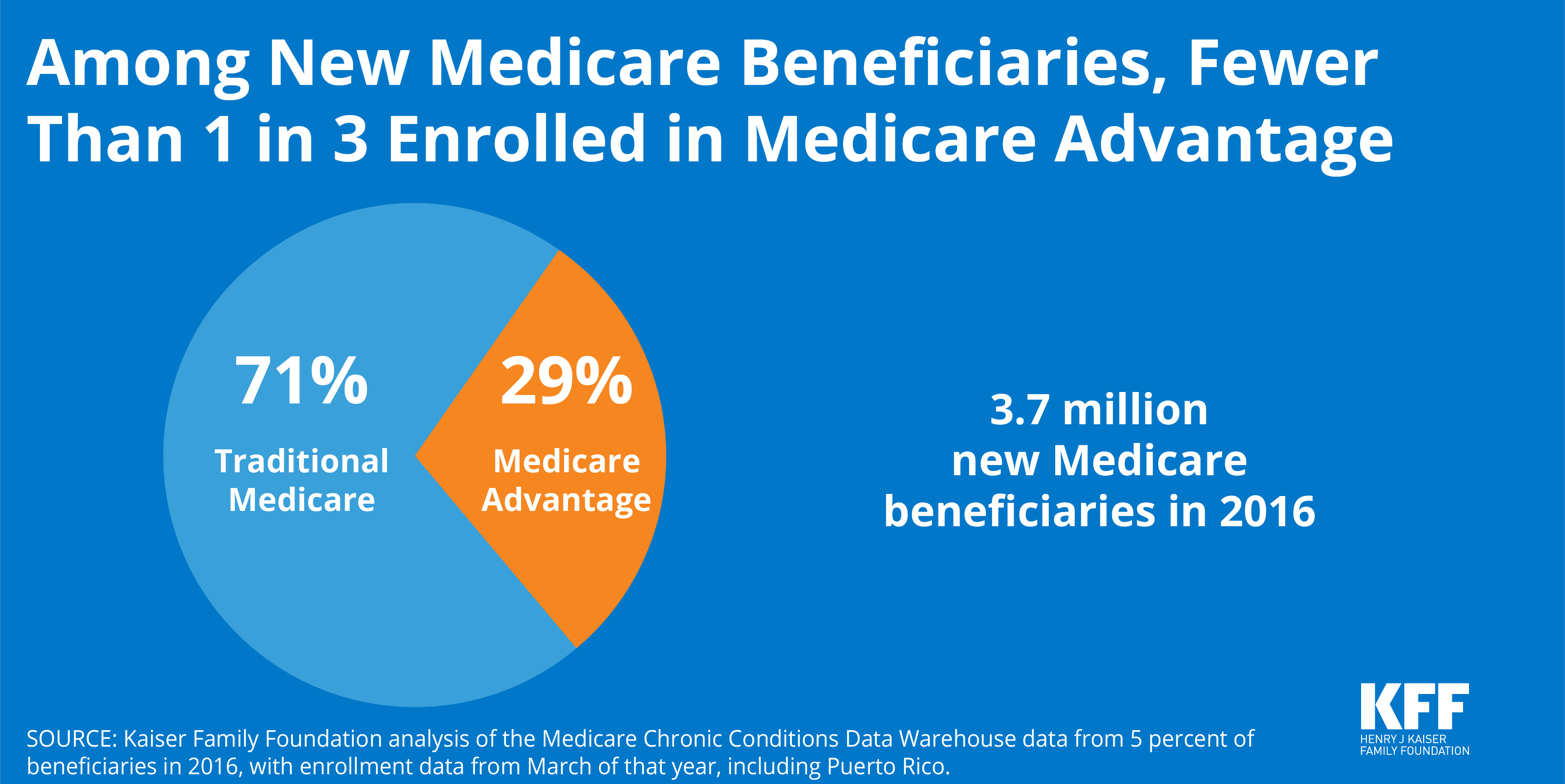

Individuals with Medicare have the choice of receiving their Medicare benefits with the typical Medicare program administered by the federal government or with a personal Medicare Benefit strategy, such as an HMO or PPO. In Medicare Benefit, the federal government agreements with private insurance providers to give Medicare benefits to enrollees.

The discount has actually raised significantly in the last numerous years, greater than increasing given that 2018. Nearly all Medicare Advantage enrollees (99%) remain in strategies that call for prior authorization for some services, which is usually not used in standard Medicare. Medicare Benefit strategies also have defined networks of service providers, as opposed to conventional Medicare.

The Best Strategy To Use For Paul B Insurance Medicare Insurance Program Huntington

Altogether, including More about the author those who do not pay a premium, the average enrollment-weighted premium in 2023 is $15 per month, and also averages $10 per month for simply the Part D portion of protected advantages, significantly less than the ordinary premium of $40 for stand-alone prescription drug strategy (PDP) costs in 2023.As strategy quotes have decreased, the discount section of strategy repayments has raised, and strategies are alloting some of those refund bucks to decrease the component D section of the MA-PD premium. This fad contributes to greater accessibility of zero-premium strategies, which brings down average premiums. Given that 2011, government law has required Medicare Advantage intends to supply an Click Here out-of-pocket restriction for services covered under Parts An and also B.

Whether a plan has only a just cap or a cap for in- and out-of-network as well as depends solutions the type of plan.

The Main Principles Of Paul B Insurance Medicare Agency Huntington

As an example, an oral advantage may consist of preventive services only, such as cleansings or x-rays, or more detailed coverage, such as crowns or dentures. Plans also differ in regards to price sharing for various solutions and limits on the number of solutions covered per year, several impose an annual dollar cap on the quantity the plan will certainly pay toward protected solution, as well as some have networks of oral providers beneficiaries need to select from.

Report this wiki page